Explore the different types of loans, how they work, and which option best fits your financial needs.

With so many types of loans available, finding the right one for your needs can feel overwhelming. Each loan type comes with its own set of features, benefits, and considerations. Understanding these options is important for making an informed decision. In this guide, we’ll explore various types of loans, offering clear insights to help you navigate your choices confidently.

At Check City, we’re dedicated to supporting you through every step of the loan process. Our goal is to provide you with the information and resources you need to choose the loan that best fits your financial needs and goals.

Long vs Short-Term Loans

Loan terms refer to the timeframe of the loan. Some loans are paid back over a longer period of time, like several years. While other loans are paid back over a shorter period of time, like a few weeks or months.

It can be a perk that long-term loans are repaid in a matter of months or years to give you more time to pay off the loan. You can also often borrow larger loan amounts to finance bigger things like buying a car or a home. Because they are longer loans, they can also come with lower interest rates, but they have a longer loan commitment.

It can also be a perk that short-term loans are repaid in a matter of weeks or months, providing a much shorter loan commitment. However, due to the shorter timeframe, these loans offer smaller loan amounts and come with higher interest rates.

Types of Long-Term Loans

A long-term loan has a longer term, like several years. This means the borrower will have several years to repay the loan.

- Auto Loan: A type of loan provided by lenders to help car buyers finance the purchase of a car.

- Student Loan: A type of loan provided by private or federal student loan providers to help students finance tuition for higher education.

- Mortgage Loan: A type of loan provided by mortgage lenders to home buyers to help home buyers finance the purchase of a home.

- Personal Loan: A type of loan that can be used for various personal expenses and is usually based on creditworthiness and income.

- Installment Loan: A type of loan that breaks payments into smaller chunks paid back in regular intervals, known as installments.

- Small Business Loan: A type of loan designed to provide funding for the financial needs of small businesses, like operational expenses, expansions, or working capital.

- Home Equity Loan: A type of loan that uses a homeowner’s property as collateral so the homeowner can borrow against the equity in their home.

- Credit-Builder Loan: A type of loan designed to help individuals improve their credit score by borrowing small amounts and making on-time payments.

- Debt Consolidation Loan: A type of loan designed to combine multiple debts into one loan to make debt repayment easier for the borrower.

Types of Short-Term Loans

A short-term loan has a shorter term, like a few months or weeks. This means the borrower will have a few weeks or a few months to repay the loan.

- Payday Loan: A type of loan with a short term and high interest rate that is generally due on the borrower’s next payday.

- Title Loan: A type of loan that uses the borrower’s vehicle title as collateral, so the car owner can borrow against the equity in their car.

- Pawn Shop Loan: A type of loan provided by pawn shops where the borrower leaves something valuable as collateral at the pawn shop in exchange for cash.

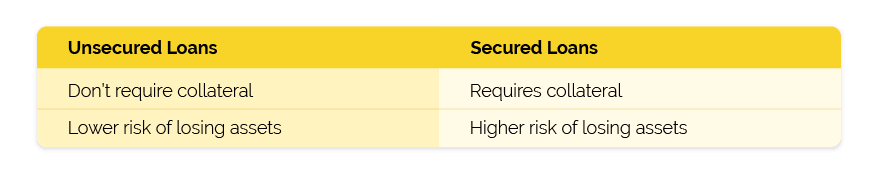

Unsecured Loans vs Secured Loans

There are many types of loans in the finance world, and they can be secured or unsecured. But what does it mean when a loan is unsecured or secured?

The main difference between secured and unsecured loans is that secured loans require collateral, while unsecured loans do not. Because of this factor, creditworthiness matters more for unsecured loans than it potentially does for secured loans.

Types of Unsecured Loans

An unsecured loan is backed by the borrower's creditworthiness and ability to repay, not by a form of collateral. Unlike secured loans, unsecured loans don’t rely on a form of collateral or asset to secure a loan but instead on the borrower’s promise to repay.

- Unsecured Personal Loans: When flexibility is key, these loans are a versatile way to cover various personal expenses like medical bills, home renovations, or vacations. No collateral is needed; instead, approval relies on your creditworthiness.

- Unsecured Installment Loans: Significant expenses become more manageable with these loans, which provide a lump sum upfront, repaid through fixed monthly payments. They’re ideal for large purchases or debt consolidation.

- Unsecured Student Loans: These loans are designed for students and don’t require collateral, which makes it more straightforward to cover education costs. A cosigner may be required if the borrower’s credit history is limited.

- Unsecured Credit Cards: These cards offer a revolving line of credit without collateral, making them a common option for accessing credit. Your financial health and credit score determine your credit limit. Monthly payments are essential to avoid fees, and paying off the balance in full can help you sidestep interest charges, making them a valuable tool for building credit responsibly.

Types of Secured Loans

A secured loan is backed by collateral—something of value that the borrower offers to guarantee the loan. This reduces the lender’s risk and may make it easier to qualify or receive better terms. If the borrower defaults, the lender has the legal right to claim the collateral.

- Title Loans: These short-term loans are secured by your vehicle title. While they provide fast access to cash, borrowers must be cautious. If the loan isn’t repaid, the lender may repossess the vehicle.

- Secured Credit Cards: Ideal for building or rebuilding credit, these cards require a cash deposit as collateral. The deposit typically determines the credit limit, and responsible use can lead to improved credit over time and possible upgrades to an unsecured card.

- Mortgage Loans: A home loan is a classic example of a secured loan, with the property itself acting as collateral. If the borrower defaults, the lender may foreclose on the home.

- Auto Loans: These loans are used to purchase vehicles, with the vehicle itself serving as collateral. If the borrower fails to make payments, the car can be repossessed by the lender.

Types of Mortgage Loans

Mortgage loans are a specific category of loans designed to help individuals finance the purchase of a property. Unlike other loans, which might be used for various purposes, types of home loans are focused on real estate and come with distinct features tailored to homebuyers.

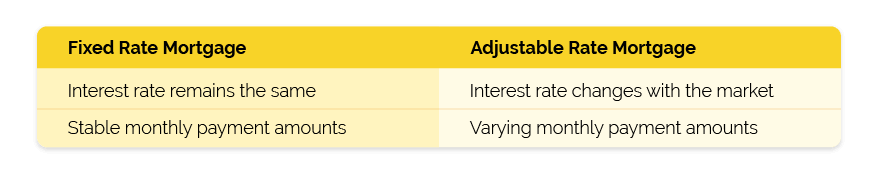

Mortgages generally fall into two main categories: fixed-rate and adjustable-rate loans.

A fixed-rate mortgage means the interest rate remains constant throughout the life of the loan, offering stable monthly payments.

An adjustable-rate mortgage starts with a lower interest rate for a set period before adjusting based on market conditions, which can lead to varying monthly payments.

Understanding these differences can help you determine which type of mortgage best fits your financial situation. Fixed-rate mortgages are ideal for those who prefer predictable payments, while adjustable-rate mortgages might benefit those who anticipate moving or refinancing before the rate adjusts.

Conventional Loans

Conventional loans are one of the most common types of home loans available to homebuyers. Conventional loans are provided by private lenders and do not have government guarantees.

They typically offer competitive interest rates and can be used for various purposes, including purchasing or refinancing a home. These types of loans usually require a higher credit score and a larger down payment compared to government-insured options.

Conventional loans are well-suited for buyers with strong credit profiles looking for flexible terms and conditions.

Government-Insured Loans

Government-insured loans are a type of mortgage where the repayment is backed by a government agency, offering additional security to both lenders and borrowers. These different types of home loans include Federal Housing Administration (FHA) and Veterans Affairs (VA) loans, each designed to help specific groups of buyers.

For example, FHA loans are geared towards first-time homebuyers with lower credit scores, while VA loans are available to veterans and active-duty military members.

Government-insured loans often require lower down payments and have more flexible credit requirements. They are ideal for individuals who may not qualify for conventional financing but are seeking affordable homeownership options.

Commercial Real Estate Loans

Commercial real estate is a type of property or real estate that is used to generate profit from capital gains or rental income. A commercial real estate loan is a type of business loan used to finance the purchase, renovation, or development of commercial properties.

The following business loans can also be used as commercial real estate loans:

- Term Loan

- Small Business Administration (SBA) Loan

- Business Line of Credit

- Bridge Loan

Types of Student Loans

Student loans come in several forms, each designed to assist with funding higher education.

- Private Student Loans: These loans are offered by private lenders and may have varying terms and conditions. By exploring these different types of loans, you can find the most suitable option to support your educational goals.

- Federal Student Loans: Like the Direct Subsidized, Direct Unsubsidized, and Direct PLUS Loans, these loans are offered by the government and provide various benefits, including fixed interest rates and flexible repayment options.

Private Student Loans

What are private student loans? Private student loans are offered by private lenders, such as banks and credit unions, to help cover educational expenses that federal loans may not fully address. These loans can be a good option for students who need additional funding beyond federal loans and have a strong credit history or a cosigner.

Unlike federal student loans, which come with standardized terms and benefits, private student loans vary significantly in terms of interest rates, repayment options, and eligibility criteria. They may offer flexible borrowing amounts and terms tailored to your financial situation, but often come with higher interest rates and less flexible repayment plans than federal loans.

Federal Student Loans

Federal student loans are provided by the US Department of Education to help students finance their education.

These types of loans offer fixed interest rates and flexible repayment options and come with various benefits, like income-driven repayment plans and loan forgiveness programs, which are not typically available with private loans.

- Direct Subsidized Loan: A type of student loan provided by the federal government where the US Department of Education pays the interest while the borrower is enrolled in school at least half-time, during deferment periods, and certain repayment periods.

- Direct Unsubsidized Loan: A type of student loan provided by the federal government where the borrower pays the interest starting from the disbursement date.

- Direct PLUS Loan: A type of student loan provided by the federal government designed for graduate or professional students and parents of dependent undergraduate students. Unlike Direct Subsidized and Unsubsidized Loans, which are based on financial need, Direct PLUS Loans are credit-based and require a credit check. They offer higher borrowing limits and can cover the total cost of education minus any other financial aid received.

Types of Business Loans

When it comes to types of loans, businesses have a variety of options tailored to their unique needs. From startups to established companies, loans for small businesses and other types of loans offer different solutions for managing cash flow, investing in growth, and handling operational expenses.

Each business loan serves a specific purpose, whether it’s for expanding operations, purchasing equipment, or managing short-term cash needs. The range of business loan options is designed to address various business needs, providing flexibility and support for achieving business goals.

Small Business Administration (SBA) Loans

SBA loans are backed by the US Small Business Administration and designed to help small businesses secure funding. They are popular for their favorable terms, including lower interest rates and longer repayment periods compared to other business loans.

Unlike conventional business loans, SBA loans come with the added assurance of partial government backing, which reduces the risk for lenders and can make approval easier for borrowers. SBA loans are ideal for small businesses looking for substantial funding with manageable terms, especially those that may have difficulty securing traditional financing.

Business Line of Credit

A business line of credit is a flexible financing option that allows businesses to access a revolving credit limit, which they can draw from as needed. This type of loan is similar to a credit card but is specifically designed for business expenses.

Unlike traditional loans for small businesses, which provide a lump sum, a business line of credit offers ongoing access to funds. This makes it ideal for managing cash flow fluctuations, covering short-term expenses, or seizing immediate opportunities. With interest only applied to the amount used, it can be a cost-effective way to handle financial needs.

Other Business Loans

- Business Acquisition Loan: A type of business loan used to finance the purchase of an existing business or business assets.

- Working Capital Loan: A type of business loan with a short term that provides businesses with funds to cover day-to-day operational expenses and manage cash flow fluctuations.

- Term Loan: A type of business loan with a fixed rate and a set repayment term used for long-term investments and business growth.

- Small Business Administration (SBA) Loan: A type of business loan program backed by the government and designed to support small businesses with various funding needs.

- Equipment Loan: A type of business loan designed specifically to help businesses purchase, finance, or lease equipment for business operations.

- Commercial Real Estate Loan: A type of business loan used to finance the purchase, renovation, or development of commercial properties.

- Invoice Factoring Loan: A type of business loan where businesses sell their outstanding invoices to a financial institution at a discounted rate to access immediate cash flow.

- Invoice Financing Loan: A type of business loan used to improve cash flow, with a short term, and secured by a company's outstanding invoices.

- Export Financing Loan: A type of business loan that helps businesses engage in international trade by financing export-related activities.

- Merchant Cash Advance Loan: A type of business loan provided to businesses in a lump sum in exchange for a percentage of future credit card sales.

- Bridge Loan: A type of business loan with a short term that bridges the gap between businesses' financing needs and covers immediate expenses until permanent financing is secured.

- Microloan: A type of business loan with a small loan amount offered by non-profit organizations or government agencies to support startups and small businesses.

- Business Line of Credit: A type of revolving credit line that provides businesses with access to a predetermined limit that businesses can borrow from for various business expenses.

Which Loan Type is Right for You?

Selecting the right loan from different types of loans is an important decision, as it will impact not only your financial well-being but also your overall borrowing experience.

With various options available, understanding the differences between short-term loans and long-term loans, as well as the impact of loan interest rates, can help you make an informed decision that aligns with your needs and goals.

When evaluating loan options, consider these key factors:

- Long or Short Loan Terms: Think about whether short-term or long-term types of loans suit your needs. Short-term loans usually offer quicker repayment schedules and may have higher monthly payments. Long-term loans spread payments over a longer period, potentially reducing your monthly burden but increasing the total interest paid.

- Secured or Unsecured Loans: Determine if you prefer a secured loan, which requires collateral and might offer lower rates, or an unsecured loan, which doesn’t require collateral but may come with higher rates and stricter requirements.

- Financial Fit: Evaluate whether the loan aligns with your current financial situation. Consider your ability to manage loan repayment within your budget to ensure you can handle the payments without financial strain.

Lastly, always review the loan agreement details carefully to understand all terms, conditions, and potential costs associated with your selected type of loan. Choosing the right loan is crucial for maintaining financial health and achieving your goals.

Related Products:

This content is for informational purposes only and does not constitute financial or legal advice. Loan products, terms, amounts, rates, fees, and funding times may vary by state and applicant qualifications. All loans are subject to approval and verification under applicable law. Check City is a licensed lender in each state where it operates. Loans are intended for short-term financial needs only. Please borrow responsibly.