Learn how to budget in just 5 simple steps, get helpful budgeting tips, and download a free budget template to get you started on the right foot.

The first step to any personal finance journey is learning how to budget in a way that actually works for you. There are many types of methods to choose from, but all of them essentially use the same 5 steps.

Learn how to make a budget in 5 simple steps so you can track your spending and gain more control over where your money goes. Organizing your income and expenses can also help you make financial plans and goals for a brighter financial future.

What is a Budget?

Before you can create a budget, you need to understand what a budget is. A budget is a financial plan and strategy for managing income and expenses. It’s how you plan, organize, and take control of your cash flow.

When looking at budget examples, you'll find they come in many forms. You could use a cash envelope system, or budgeting tools like a budgeting app, or a budget spreadsheet.

Learn how to make any budget, no matter the method you choose, with these 5 basic steps.

Step 1: List All Sources of Income

The first step is to sit down and list all sources of income. Income includes any money you receive regularly like money from your paychecks. You might have fixed income, variable income, or passive income.

Fixed income includes steady income that is the same amount, or very nearly the same amount, and is paid to you on a regular schedule like wages and paychecks from a regular job. Variable income includes sporadic income that is more irregular in amount or frequency like tips or freelance money. Passive income includes income from sources that don’t require regular active work like investments or royalties.

Some examples of sources of income might include:

- Salary or wages

- Bonuses or incentives

- Tips or gratuities

- Freelance or contract money

- Small business earnings

- Interest earned in savings accounts

- Interest earned in investment accounts

- Dividends from investments

- Royalties on intellectual property like published books, music, etc.

- Social Security benefits

- Pension or retirement money

- Alimony or child support money

- Government assistance money like unemployment or disability payments

- Rent income from rental properties

After you've made this list, add your sources of income together to get your total monthly income. Now you know exactly how much money you have for spending and saving each month.

You can also calculate your gross income (also gross pay), adjusted gross income, or net income (also net pay or take home pay). Many people like to use take home pay when calculating total income because this amount is what actually ends up in your banking accounts.

Step 2: List All Fixed Expenses

After you have all your income sources listed, it’s time to list all your fixed expenses. Fixed expenses are any regularly recurring expenses that don’t fluctuate in amount like monthly rent and bills.

For example, if you have a monthly subscription payment that is always $30, then that’s a fixed expense. But if you have an electric bill that fluctuates depending on your usage between $30 and $100 a month, you might consider this a variable expense instead.

Everyone’s list of fixed expenses is going to look different depending on what expenses do and don’t apply to you. Here is a list of example fixed expenses to help you make your list:

- Rent or mortgage payments

- Health insurance

- Car insurance

- Renter’s or homeowner’s insurance

- Car loan

- Student loans

- Phone bill

- Monthly medication

- Child support

- Credit card payments

- Subscription services like Netflix, Hulu, Spotify, etc.

After you've made this list, add your fixed expenses together to get your total monthly fixed expenses.

Then, subtract your total monthly fixed expenses from your total monthly income, and that’s what you have left to spend on variable expenses for the month.

Step 3: List All Variable Expenses

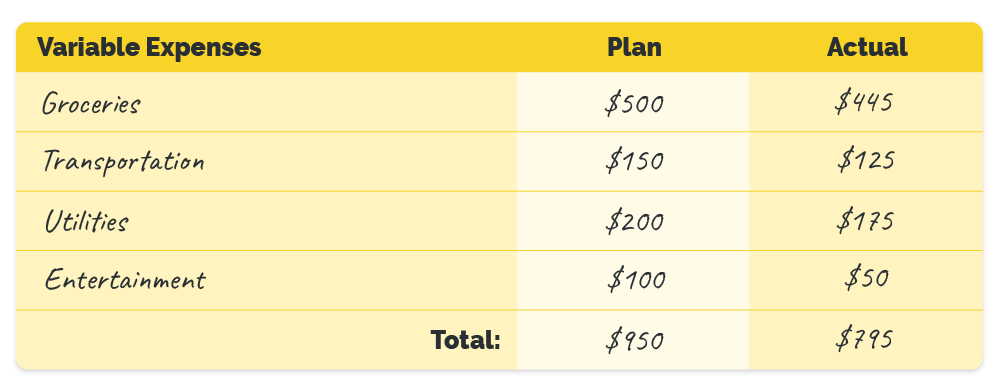

After you have all your income sources and fixed expenses listed, it’s time to list all your variable expenses. Variable expenses are any regularly recurring expenses that fluctuate in amount like groceries and gas money.

For example, if you spend $300 on groceries one month, but the next month you spend $245, then that indicates that this is a variable expense for you. Any expenses you have each month that vary in amount month to month would be considered a variable expense.

Everyone’s list of variable expenses is going to look different depending on what expenses do and don’t apply to you. Here is a list of example variable expenses to help you make your list:

- Groceries

- Gas money or bus fares

- Utilities like electricity, water, gas

- Hygiene and personal care products

- Dining out

- Entertainment

- Recreation

- Clothing

- Travel and vacations

After you've made this list, add your variable expenses together to get your total monthly variable expenses.

Then, make plans for how much you want to allocate to each variable expense, and review how much you actually spent at the end of each month.

Step 4: Set Budgeting Goals

After you have all your income sources, fixed expenses, and variable expenses listed, it’s time to make goals. Budgeting goals are any financial goals you might want to plan including plans to save money, build an emergency fund, or save up for a house.

For example, if you want to save up for a car, then you might look into car prices and set a savings goal for $10,000. Then you can make adjustments as needed to set a plan for how exactly you’ll meet this savings goal, like putting aside $833 a month for a year or $417 each month for 2 years.

Everyone’s savings goals are going to look different depending on what your financial goals, plans, and needs might be. Here is a list of example savings goals to help you make your list:

- Building a general savings account

- Building an emergency fund

- Saving for retirement

- Saving for a downpayment on a house

- Saving for a downpayment on a car

- Saving for home renovations

- Saving up for a yearly vacation

- Saving tuition money for a child’s college fund

After you've made your savings plans and know how much you need to put aside each month to reach these goals, you can make changes in your fixed and variable expenses to help fit these plans.

For example, if you want to put aside $100 each month to build up your savings account, but your budget is already zeroed out, then that might mean you need to let go of unnecessary or luxury expenses like subscription services or eating out.

Any amount you can afford to put away into a savings account each month will set you up for success in the long term, even if it’s only $5 to $10 a month. It’s important to make budgeting plans not only for the short term but for the long term as well.

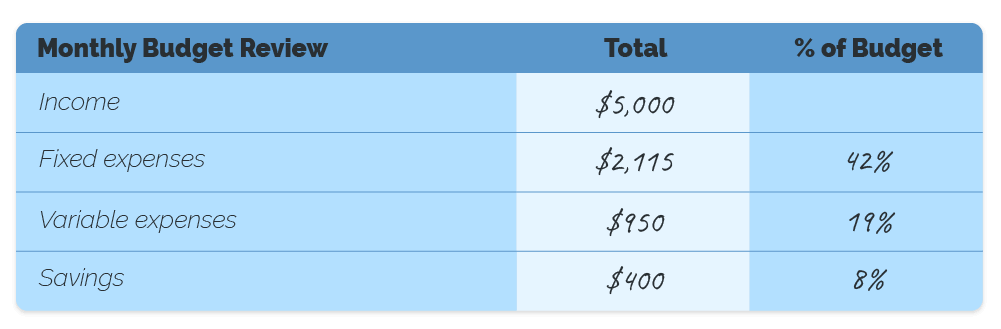

Step 5: Make Budget Calculations

The final step to how to budget money is making budgeting calculations to adjust your income and expenses as needed.

The goal to any budget is to have money left over at the end of each month so you aren’t spending all of your money and potentially living paycheck to paycheck. By not zeroing out your budget each month you also have more money to set aside for saving, investing, and emergencies.

If your budget is close to zero at the end of each month, there are a few budgeting tips you can use to decrease spending and reach more of your financial goals.

- Use the 50/30/20 budgeting method to keep your necessary expenses below 50% of your total budget, your luxury expenses below 30% of your total budget, and put at least 20% of your total budget toward savings.

- Use the cash envelope budgeting method to more strictly control how much you can spend on certain budget categories.

- Use reloadable prepaid cards to more strictly control how much you can spend on certain budget categories.

- Reduce unnecessary expenses like subscription services, dining out, or recreational activities.

- Find less expensive options for necessary expenses like switching to a cheaper phone plan or splitting the rent with a roommate.

- Apply for better-paying jobs or start a side hustle to increase your total income.

Download a Free Budget Worksheet

A monthly budget template is a great place to start keeping a monthly finance planner to track and organize all your costs. It’s an especially great place to start for anyone looking for how to budget money for beginners.

Download the Cash Academy’s free budget worksheet below to get started on your own financial planning today!

Why Budgeting is Important

Now that you know how to make a monthly budget let’s review why you need one in the first place. Learning how to budget and save money is important because it will not only save you money, but can help you gain more money too. The best budget planner helps you not only save but invest in your financial future to make more money in the long term.

Not only can it help you save money and invest to make more money, but a detailed budget sheet can also act as a bill organizer so you can avoid fees and bills you can actually do without. Budget trackers can also help you organize your savings and checking account, prepare for unexpected expenses, and prioritize debt payments so you can work on paying off debts.

- Save and invest for your financial future.

- Organize bills and avoid late fees.

- Control spending and avoid overdrafts.

- Organizes financial accounts.

- Prepares for unexpected costs.

- Pay off debts.

- Break the paycheck-to-paycheck cycle.

By mindfully managing the flow of money in and out of your wallet you can have better control of your finances, stop living paycheck to paycheck, and reach financial freedom.