Understand the difference between a title loan that uses your vehicle as collateral to get a loan vs an unsecured loan that doesn’t use collateral in the application process.

If you need a little cash, you may be wondering which option is best: a title loan or an unsecured loan? The answer depends on your credit, the amount of money needed, and how quickly you need it, among other factors.

To help you choose the best option for your situation, let’s explore how these loans work, how they differ, and which scenarios are ideal for taking out a title loan vs an unsecured loan.

Unsecured loans are an option for those with good credit who want to access more cash at a lower interest rate. Title loans, on the other hand, can cover emergency expenses or short-term needs. Because they’re secured with a vehicle title, title loans may be available to borrowers who might not qualify for traditional credit. Credit verification requirements can vary by lender and state.

What is a Title Loan?

A title loan is a type of small secured loan. Borrowers can use a clean and clear vehicle title to access funds quickly from a title loan company. Because the loan is secured with your car, you must own your vehicle outright to apply.

The loan amounts are often low, as they’re based on the car’s value. Title loan rates are usually higher than traditional bank loans since they’re short-term and based on the value of your vehicle. In some cases, the APR can be quite high depending on the loan amount, term, and state laws.

While the loan is in effect, the vehicle title acts as collateral. So if a borrower doesn’t pay back what they owe, their vehicle may be repossessed and sold to repay the loan.

What is an Unsecured Loan?

An unsecured loan is a type of loan with zero collateral requirements. Instead, eligibility is based on your creditworthiness. The better your credit, the higher your approval odds, and the better your loan terms will be.

Unsecured loans come in many forms and can include:

- Personal loans

- Student loans

- Home improvement loans

- Debt consolidation loans

- Installment loans

Even credit cards and other lines of credit can be considered a type of unsecured loan. These loans often have high values ($10,000 or more) and long repayment periods (up to 7 years). This extended time helps ensure monthly loan payments are manageable.

To qualify for an unsecured loan, it's best to have good credit, a low level of existing debt, and a solid W-2 work history. If you have less-than-stellar credit, you could end up with an interest rate well above 20%.

What are the Key Differences Between Title Loans and Unsecured Loans?

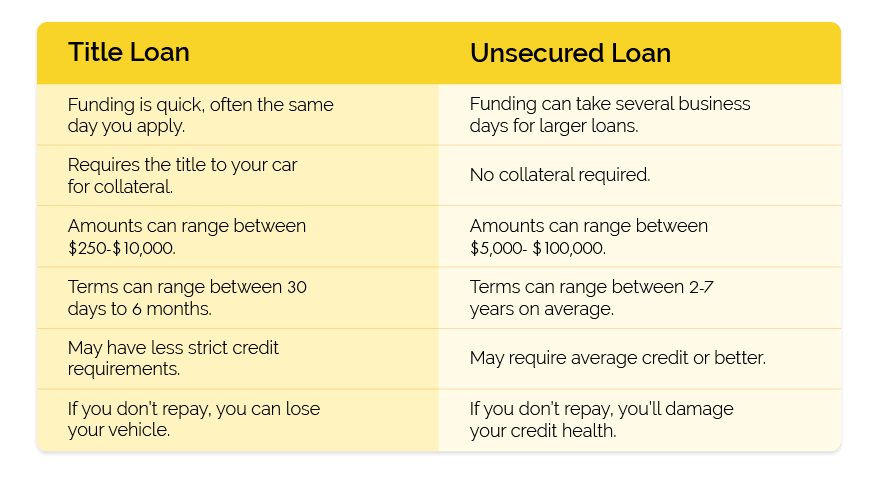

When comparing title loans against unsecured loans, there are a few significant differences to be aware of. For example, title loans require collateral, have smaller amount ranges, and shorter terms, while unsecured loans don’t require collateral and can have larger amount ranges and longer terms.

Pros and Cons of Title Loans

There are several advantages and disadvantages when it comes to applying for and taking out a title loan.

Pros

- Quick access to funds - Title loans are often funded the same day, sometimes taking less than an hour from application to money in hand.

- Less strict requirements - Title loan companies usually have less strict application requirements, making it easier to apply.

- Fast, straightforward application process - The application is usually short, there’s no credit check, and very little additional information is needed from you.

Cons

- High interest rates - The rates on title loans can be higher.

- Risk of repossession - You put up your car title for collateral, so if you don’t pay back the loan, the lender can repossess your vehicle.

- Short repayment terms - Because title loans are smaller in value than traditional loans, the repayment period is very short, usually 6 months or less.

Pros and Cons of Unsecured Loans

An unsecured loan also has its benefits and downsides. Let's quickly review the pros and cons of applying for and using an unsecured loan.

Pros

- No collateral required - As the loan is unsecured, it doesn't require any collateral.

- Larger loan amounts - For qualified borrowers, loan amounts can range from $5,000 to over $50,000.

- Longer repayment terms - Because the amount you can borrow is higher, the time you have to pay the money back is longer.

- Lower interest rates - The better your credit, the better your APR.

Cons

- Requires good credit - To qualify for a secured loan, you need good credit.

- Long approval process - The application and approval process is more complicated and can take as much as a week to complete.

- Pay more in interest - If you have bad credit, you could get stuck with a high interest rate that could cost you thousands over the life of the loan.

When Should You Consider a Title Loan?

Applying for a title loan can be a good idea in various circumstances. Let's quickly review the pros and cons of applying for and using a title loan.

- Emergency situations - If you’re hit with unexpected emergency expenses, such as car problems, taking out a title loan may be a good move. The quick and simple application and approval process can get you cash fast, usually the same day, if not within the hour.

- Short-term needs - Another use for title loans is to cover short-term needs. For instance, if you are transitioning to a new job and find your paycheck a little short this month, a title loan can help you bridge the temporary gap.

- Poor credit - For those who have poor credit, taking out a title loan may be one of the options available. A low credit score means you’re less likely to qualify for a traditional loan. And if you have no credit history, a traditional lender may not approve your application. When applying for a title loan, a credit check is usually not required, making it much easier to qualify for funds.

Before taking out a title loan, be sure to ask yourself if you are reasonably able to repay the loan. If for whatever reason you are not able to make your loan payments on time, contact your lender directly for help.

When Should You Consider an Unsecured Loan?

If you need access to more than $5,000, an unsecured loan may be an option for you. Keep in mind that loan values are determined by creditworthiness and the lender, so if you have decent credit, you may have access to higher credit limits. Here are some other scenarios in which unsecured loans may be the choice for you.

- Lower monthly payments - An unsecured loan can be the way to go if you’re looking for a manageable monthly payment plan. Repayment terms often extend up to 5 years or more. This extended repayment length can dramatically lower your individual monthly payment.

- Lower APR - Landing a lower APR is another good reason to consider an unsecured loan, especially if you have good credit. When applying, the bank will check your credit, income, debt level, and more. If they find you have good credit, they are likely to extend you a higher loan value, longer repayment period, and most importantly, a lower interest rate, which saves you money in the long run.

- Unwillingness to risk your car - A final reason to consider an unsecured loan over a title loan is if you’re unwilling to risk your vehicle. If you aren’t comfortable putting your car up for collateral and potentially losing it if you’re unable to repay, taking on an unsecured loan can be a better choice than a title loan.

Title Loan vs Unsecured Loan Comparison

To help you decide, let’s take a closer look at the key differences between title loans and unsecured loans.

Loan Amounts

The value of a title loan is based on your car’s value, while the value of an unsecured loan is tied to your creditworthiness and ability to repay. Because of this, available loan amounts are generally higher with unsecured loans.

Typically, title loans range from $100 to $10,000. Unsecured loans usually start at $1,000 and can go up to $50,000 or more for borrowers with excellent credit and stable income.

For those who have poor credit, available loan values for title loans and unsecured loans may be roughly the same.

Interest Rates

Interest rates are expressed as the rate paid over the course of the year: the annual percentage rate, or APR. The APR takes into account all of the loan fees you pay to determine your interest rate.

For title loans, fees can be high, which results in a high APR. Likewise, the shorter your repayment period, the higher the APR. Title loan interest rates often average between 25% and 300%+ or more.

In comparison, interest rates on unsecured loans are typically significantly lower, ranging from 6% to 36%, depending on creditworthiness. Those with excellent credit scores (800+) could land rates under 10%, while those with below-average credit (under 670) may get stuck with APRs in the upper ranges.

Repayment Periods

When it comes to repaying the loan, you usually have more time with an unsecured loan compared to a title loan. This can be both good and bad.

If you want a more manageable payment, an unsecured loan with an average repayment period of one to five years would be a solid choice.

However, if you want to get out from under interest charges quicker, then the one- to six-month repayment periods available on title loans may be preferable.

Credit Concerns

An unsecured loan will require a credit check, while a title loan usually doesn’t. This means those with poor or no credit may be better off applying for a title loan, while those with good credit may benefit more from an unsecured loan.

It’s also worth noting that a credit check for a loan application requires a hard pull of your credit, and the inquiry can temporarily lower your score. However, if you manage the new loan well, it should improve your score over time.

Title loans usually only appear on your credit history if you miss payments. Unfortunately, this means they cannot help you improve your credit.

Approval Process

Lower loan values, shorter repayment periods, and no credit check mean that the title loan application process is typically quick and easy.

With an unsecured loan, the application will likely be more complicated. You’ll have to agree to and wait for a credit check and enter income info, and you may be required to send in supporting documents. The bank then has to review all of this information before making a decision, which can take anywhere from a few days to a week.

Risks

Every loan comes with some kind of risk. For a title loan, the risk is losing your car. Because your title is used to secure the loan, the title loan company can take your car if you don’t repay it.

In contrast, there is no collateral on an unsecured loan. In the immediate sense, there is nothing for the bank to take back if you are unable to pay. However, they can and will report your default to the credit bureaus. This can seriously damage your credit and prevent you from obtaining loans or lines of credit in the future.

Get the Loan You Need From Check City

The right loan for you will depend on your unique financial situation. Both title loans and unsecured loans have significant advantages and drawbacks.

With years of experience in the financial industry, Check City can help you sort through the options and choose the best fit for your circumstances. Reach out to one of our friendly, knowledgeable agents today.

Key Takeaways

- Unsecured loans: Larger amounts, lower interest, longer terms, best if you have good credit.

- Title loans: Fast cash, no credit check, short terms, best for emergencies if you own your car.

- Title loans carry high interest and repossession risk; unsecured loans risk your credit score if you default.

- Use title loans for short-term needs with poor credit; use unsecured loans for bigger, lower-cost borrowing with strong credit.

This content is for informational purposes only and does not constitute financial or legal advice. Loan products, terms, amounts, rates, fees, and funding times may vary by state and applicant qualifications. All loans are subject to approval and verification under applicable law. Check City is a licensed lender in each state where it operates. Loans are intended for short-term financial needs only. Please borrow responsibly.